[su_box title=”Keep in mind…” style=”default”]

- Family health insurance policies are not one-size-fit-all

- You are able to customize your family’s health insurance plan

- High-risk health insurance is available for those with pre-existing conditions

[/su_box]

Finding the best family health insurance plan can be a challenging task as there is no one best solution for everyone.

What works best for one family might not work as well for another. Because of this, you need to shop around, learn about coverage and compare multiple options before selecting a provider.

Keep your family as healthy as possible by comparing health insurance quotes today!

What is the best family health insurance plan?

This all depends on your family and unique needs. When looking for the best family health insurance plan you must determine your family needs and find a policy that provides coverage best for you.

It’s also important to know what budget can afford. Having health insurance can be expensive, but family health insurance is even more expensive than individual health insurance.

Going with your employer’s health insurance is often the most cost effective if they offer a family plan. While family health insurance plans through employers are still expensive (the average being over $13,000 annually) it can cost more not to have it when a medical emergency arises.

Family health insurance plans through employers can help cover several medical expenses. Some of which include:

- Hospital expenses

- Doctors’ visits

- Treatments for chronic diseases

- Preventative medicine

- Prescriptions

- Other illnesses

One of the other benefits to having family health insurance through an employer is that you can’t be denied coverage for insurance because of pre-existing conditions thus a work policy should cover everyone in your family.

Is private health insurance a good option for family health insurance?

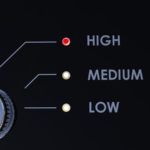

There are some company’s who give the option of picking and choosing different plans to meet each individual family member’s needs, but keep all individuals on one plan.

Being able to choose your coverage can be better when trying to stick to a budget and can help keep you from having to compromise on individual needs for health insurance.

Are there other options if you can’t afford private health insurance?

Low income families may qualify for some Medicaid assistance and there are a number of cheaper basic health insurance policies around but you really need to find a way to budget for a reliable health insurance plan.

The cost of not having health insurance is far greater than the cost of monthly premiums. Health insurance is a necessary evil in America.

Another option for family health insurance is through organization’s membership benefits. Many people forget about this as a low cost insurance option for their family.

When looking into organization membership group insurance, the first thing you want to do is look into the insurance offered by groups in which you’re already a member.

If you’re not part of an organization, but want to find one, it’s a good idea to research which organizations you would be eligible to join. Once you find organizations that you’re eligible for, check out their benefits package.

Do comparisons of each organization’s health insurance options and take into account their annual membership fee. While most will end up being more expensive than an employer’s health insurance, you do see lower rates because of the group discount.

What if I have a family member with pre-existing health issues?

Most states offer a high-risk health insurance pool. With these pools, families who have high-risk members can find an option that will cover all their medical needs. However, it is not cheap and some are even closed to new members.

State high-risk health insurance pools can be on the expensive side, but may be the only alternative for those with pre-existing illnesses. For those looking to cut costs, it is possible to insure some family members with one policy and others with another.

For example, since high-risk health insurance is costly, it would be less expensive to cover just the individual family member with the pre-existing illness and those family members without illnesses could be covered by a less expensive insurance plan.

Finding the best family health insurance plan is all about balancing the family’s needs overall. Luckily, there are many health insurance companies waiting to insure families and to work with plans and policies to fit everyone’s needs.

Once you’ve done your research, you can contact health insurance agents to see what they’d be able to do with the policy to make it work for your family.

Protect your family in every way by comparing health insurance quotes now!

[su_spoiler title=”References:” icon=”caret-square” style=”fancy” open=”yes”]

- https://www.humana.com/health-care-reform/budget

- http://obamacarefacts.com/obamacare-facts/

- http://www.medicalnewstoday.com/info/medicare-medicaid

- http://www.webmd.com/health-insurance/insurance-costs/how-to-find-low-cost-health-insurance

- http://www.ncsl.org/research/health/high-risk-pools-for-health-coverage.aspx

[/su_spoiler]