[su_box title=”Keep in mind…” style=”default”]

- Some commercial health insurance plans provide medical protection and income protection in case of disability

- Consumers can purchase commercial health insurance as group policies, individual, and family coverage

- For-profit insurance companies sell commercial health insurance, and usually through brokers and agents

- Commercial insurance providers focus on profits and prefer to avoid risk and high-cost applicants

[/su_box]

In a strict sense, commercial insurance is any health plan that is not provided by a public body or government agency like Medicaid. The focus of commercial health insurance is corporate profit for the provider and its shareholders, owners, or stakeholders.

Commercial health insurance is also a type of health insurance with income protection coverage. The providers of this type of insurance are for-profit, private insurance companies.

Get free health insurance quotes now and find out how much you could save! Enter your zip code above to get started!

Profit Over People

The primary focus of public programs like Medicare is the best interest of the people; the commercial health insurance provider’s goal is corporate profit. The private commercial insurance provider must carefully balance risk, premium income, and overall costs of medical care for the insured population.

Disability insurance complements health coverage. Whether paid by the employee or the employer, the disability insurance protects continuation of income.

Disability Enhancement

Disability insurance enhances qualified health insurance by protecting a percentage of income from loss due to illness or injury. One can classify disability coverage into two groups. First, the short-term disability; it has a limited duration.

Second, long-term disability protection with benefits that can potentially last a lifetime. Disability policies have renewal protection and cancellation guarantees. These important protection features are essential parts of disability protection.

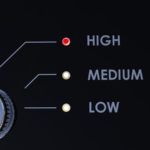

Short-Term Disability policies (STD)

- STD typically have a waiting period up to two weeks days.

- STD pay benefits for a maximum period of two years or less.

Long-Term Disability policies (LTD)

- LTD policies have wait periods; they vary in length from two weeks to several months.

- LTD policies offer a range of benefit periods. Policies offer maximum benefit periods ranging from two years to lifetime.

– No Cancellation for Disability Insurance

Non-cancellation protection guarantees continuation of the benefit despite changes in health or circumstances. The sole grounds for cancellation is nonpayment of premium. This protection feeds into the next item, renewal rights.

– Guarantee of Renewal

The right of renewal protects the level of benefits and premium. Policyholders can renew every year without an increase in premiums or a decrease in benefits. The insurer must treat every member of the community-rated class equally.

Some states permit an exception to the rule against increased premiums. If state laws permit an increase based on some specific cause, then the insurer must raise the premiums for each member of the class.

Outside the Marketplace

Persons with incomes above 400 percent of the poverty line do not qualify for Obamacare financial assistance. High-income earners can buy policies on or off the marketplace during opens season for the same price.

After the open season, insurers, brokers, and agents sell commercial health insurance. These policies are consistent with state laws in the states in which they are sold.

- Some plans sold by agents, brokers, and insurers outside of the Marketplace meet the requirements of the ACA. Policyholders of these policies will not have to pay the tax penalty. The statement of benefits, as well as the sellers, provide this information.

- Most plans sold outside the Marketplace do not meet the standards for Qualified Health Plans.

Commercial Insurance and Risk

Commercial insurance providers focus on profits, and they do so by avoiding risk wherever possible. The insurers gain bigger rewards on the profit side when they can avoid the sickest individuals.

In group insurance, they have used riders and carve-outs to modify the standard policy to accommodate high-risk individuals in a group population.

Commercial insurers unlike Medicare or Obamacare, do not seek out and insure sick persons. They prefer to avoid them by any available means. Obamacare and Medicare also contribute to financial instability; out-of-pocket costs can consume large portions of a family’s annual income.

State Regulations

State laws and regulations control commercial health insurance. States authorize lines of business and set requirements for financial reserves and stability. Commercial health insurance plays important roles in public and private group insurance coverage.

Federal Regulations

The Affordable Care Act requires standards for coverage in order to avoid the individual or employer penalties. Obamacare reduces the discretion of commercial providers to avoid sick people and to discriminate on the basis of price.

- The Department of Labor oversees private group health benefits.

- ERISA covers health benefits maintained by an employer, labor organization, or both.

- The Department of Health and Human Services enforces the important provisions of the HIPAA that protects medical privacy and guarantees continuation of coverage.

Types of Commercial Health Insurance

Most commercial health insurers use indemnity or a fixed fee for services approach. Insurers that pay with fixed fees use a complex formula to establish prices; it is an enhanced form of the usual and customary standard that includes the fees and overhead such as malpractice insurance.

The private insurance management typically uses an HMO-style with a primary care physician or the PPO which gives more freedom to consumers.

– Indemnity Model

In limited coverage situations, the indemnity model is a popular choice among commercial providers, indemnity allows consumers to pick and choose their medical care providers, and the payer sets the allowed fees.

– The POS Model

Has the primary care physician like the HMO but permits outside referrals like the PPO. When referred outside of the network, consumers get cost sharing payments. The Point of Service model is a widely used form of commercial health insurance.

– HMO Model

The HMO model uses the primary care physician to provide care and make a professional assessment of the need for treatment. The PCP can then make a plan of action involving network specialists as needed for tests, diagnoses, and treatment.

- Primary care physician must make referrals to authorize use of network resources.

- The plan encourages use of low-costs network providers and does not share costs on outside spending.

- The HMO seeks to make maximum use of resources by using professional guidance.

– PPO Model

The PPO model for commercial health insurance doesn’t use a primary care physician to oversee care and ration resources. Customers can self-refer to any in-network resource. The flexibility comes with a price as the PPO model is substantially more expensive than the HMO type.

– The FFFS Model

Some commercial insurers use the fixed fee for services approach. The fixed fee concept is similar to Original Medicare in which the payer sets prices for services and the consumer can select any provider that accepts the fixed fee.

– Catastrophic Coverage and Carve-outs

Consumers may prefer low-cost premiums and high deductibles that essentially protect against a severe illness or serious medical event. These policies offer low premiums and consistently higher prices for services and benefits.

Some policies carve out areas for protections such as a cancer policy or a policy that begins paying benefits only after a period of prolonged hospitalization.

Medicare Mission

Medicare is a federal program administered by the Centers for Medicare and Medicaid. Medicare is a national insurance program.

Eligibility comes with age and participation in a work life insurance program to pay for the benefits at or near retirement.

The purpose of Medicare is to protect older and disabled American from the risk of financial ruin due to an unforeseeable illness, condition, or injury.

Medicare Social Roots

Medicare pools the resources of many millions of workers and the nation itself to protect older workers. All US workers participate in the financing, and all participants are welcome to join. The rule is that no qualified applicant can be excluded because of age, gender, health status, or income.

Medicare pays for all necessary care for the eligible population. Medicare provides coverage throughout the US. Medicare covers hospital and medical services, and it only denies care that is not deemed medically necessary.

Medicare’s Big Responsibility

Medicare covers a large and diverse national population. Participants can join at age 65 or earlier in the event of a disability. Medicare does not use medical underwriting nor discriminate as to price or terms due to pre-existing conditions.

The sick are welcome, and the coverage for disease, illness, and chronic conditions is extensive. Medicare has several guaranteed-issue situations.

Social versus Commercial Insurance

Medicare and Obamacare are examples of social health insurance. They encourage inclusion by easy to reach standards for participation and seek to have the widest possible base of participants.

Risk Averse versus Inclusion

Social insurance systems seek to include everyone whether sick or healthy. It is important for social systems to include healthy individuals with little or small needs for medical care. These healthy individuals are also the ideal target audiences for prevention, wellness, and long-term health improvement.

Commercial insurance is risk averse, and primary concern is adverse selection or signups by sick or at risk applicants.

Commercial Insurance and Children

Commercial insurance does not maintain social objectives; private insurers focus on profits, risk avoidance, and selectivity. Children’s insurance can be a casualty of commercial insurance priorities such as costs reduction and avoiding adverse selection.

Group Dependents

Commercial insurance raises premiums and deductibles. Employers and employees can use health reimbursement and savings accounts to cover out-of-pocket costs. The narrowing of benefits is another coverage issue not solved by costs reduction.

- Low-income parent coverage affects low-income families and their children. Commercial insurance drives premiums upward out of reach and reduces benefits.

- Developmental issues, mental health, and complex medical issues get less protection as benefits narrow.

Narrow Networks

- Small networks diminish choices for child wellness and prevention.

- Limited networks reduce the amount and availability of Child specialties.

Long-Term Care and Gaps

Both commercial and social health insurance leave gaps in care. Some of the typical gaps include loss of income, and long-term care.

Shifting to Value-Based Billing and Payment

The CMS has shifted its payment priorities to reinforce patient outcomes and quality of care. The shift away from volume and towards patient outcomes promises to improve medicine and health. Coding is the method for transmitting commercial insurance billing information, and coding does not currently account for superior patient outcomes.

Don’t settle for being just another customer; find a health insuarnce provider that offers you the type of personalized service and access to resources that you deserve. Enter your zip code below to compare free quotes now!

[su_spoiler title=”References:” icon=”caret-square” style=”fancy” open=”yes”]

- https://www.healthcare.gov/glossary/medicaid/

- https://www.healthcare.gov/medicare/

- https://longtermcare.acl.gov/the-basics/index.html

- https://www.healthcare.gov/health-care-law-protections/rights-and-protections/

- https://obamacarefacts.com/private-health-plans-outside-the-marketplace/

- https://www.healthcare.gov/lower-costs/save-on-out-of-pocket-costs/

- https://www.dol.gov/general/topic/health-plans

- https://www.hhs.gov/programs/hipaa/index.html

- https://www.healthcare.gov/choose-a-plan/plan-types/

- https://obamacarefacts.com/health-insurance/fixed-benefit-health-insurance/

- https://www.healthcare.gov/glossary/primary-care-physician/

- https://www.healthcare.gov/glossary/health-maintenance-organization-HMO/

- https://www.cms.gov/Medicare/Medicare-General-Information/MedicareGenInfo/index.html

- https://www.medicare.gov/supplement-other-insurance/when-can-i-buy-medigap/guaranteed-issue-rights-scenarios.html

- https://www.healthcare.gov/medicaid-chip/childrens-health-insurance-program/

- https://longtermcare.acl.gov/costs-how-to-pay/what-is-covered-by-health-disability-insurance/

[/su_spoiler]